The Peoples Democratic Party and other stakeholders on Monday called for broader consultations among relevant stakeholders to address concerns over the tax bills currently before the National Assembly for consideration and passage.

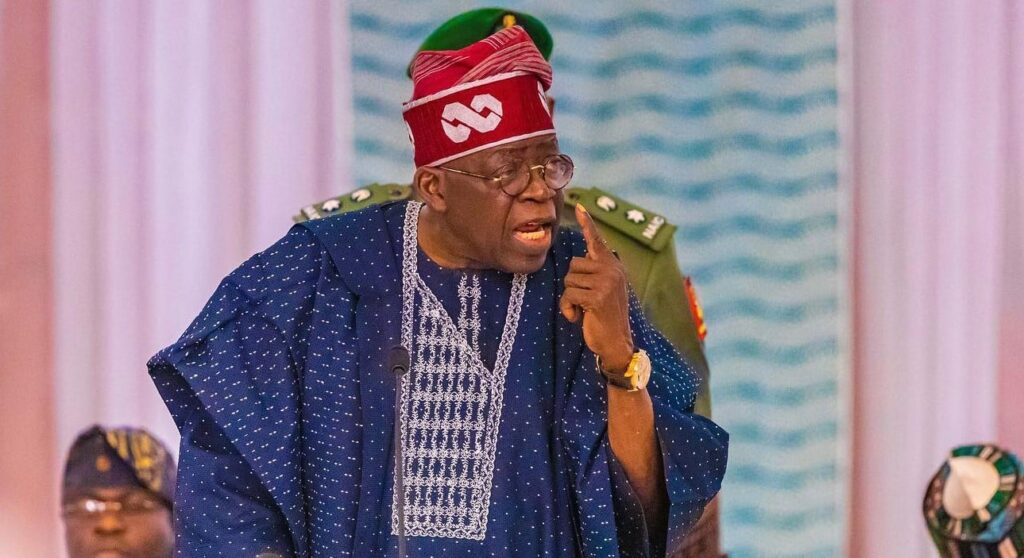

The PDP Deputy National Publicity Secretary, Ibrahim Abdullahi, and the Deputy National Youth Leader, Timothy Osadolor, wondered why President Bola Tinubu was in a hurry to pass the bills.

For more than two weeks, the bills have sparked widespread controversy with some northern lawmakers strongly opposed to the passage of the bills.

Following approval of the Federal Executive Council in October, President Tinubu transmitted four tax reform bills to the National Assembly for consideration.

The Federal Government says the bills are aimed at overhauling the nation’s tax system.

They include the Nigeria Tax Bill 2024, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

The proposed legislation seeks to consolidate existing tax laws, establish clearer frameworks for tax administration, and create bodies like the Tax Appeal Tribunal and the Office of the Tax Ombudsman.

In an interview with The PUNCH on Monday, Abdullahi said the government needed to recognise the significant implications of the bills, stressing that the collective interest of the citizens should be the priority.

He stated, “My take aligns with the position of the majority of Nigerians. If the elite members of society, particularly the governors, are apprehensive, it calls for an expanded or broader review of the situation.

“The government needs to realise the great implications of this, as the collective interest of the citizenry should be at the forefront. Governors, being in a position to understand these implications, should be involved.”

He added, “However, I do not believe this should be a priority going forward for this country. Nigerians have been struggling since the arrival of this government, with skyrocketing inflation and harsh economic policies.

“The effects have been severe, whether it’s the floating of the naira, the removal of subsidies, or the numerous taxes that the country has had to deal with over the past year. It’s time for a change, as it’s not in the nation’s best interest to rush this process.

“If there are no sinister motives behind it, why the haste? We need more time for Nigerians to review and evaluate the implications of these decisions. If it truly serves our interest, it will be accepted naturally. However, the rush with which the government is pursuing this raises doubts about the sincerity of their intentions.”

Also speaking, Osadolor acknowledged that the concept of tax reform was positive but urged the Federal Government not to rush the process.

He said, “There should have been wider and deeper consultations. You see, democracy is about the participation of everyone, not a Nazi-style approach to issues.

“If there is a large and strong call for more understanding, there is no need for a rush. Even in the past, without these tax reforms, we moved on.

“I don’t see how waiting for a week, two weeks, or even up to six months to explain this cause and gather input from other Nigerians would be a problem. It’s always good to consult and communicate with the people so that unnecessary conflicts can be avoided.

“The idea of the tax reforms is welcome, but there are clauses that I think people are unhappy with, and that I, too, find uncomfortable. So, I believe that if there had been more consultations, more public hearings, and more engagement with the states, many of these conversations and frictions across the country would not be happening now.”

Labour Party

The Presidential candidate of the Labour Party in 2023, Peter Obi, also called for transparency in the proposed tax reforms to build public trust.

Obi made the recommendations via his X handle on Monday.

He said, “’Tax reform is a critical issue, and there is nothing wrong with pursuing it. However, such reforms must be subject to robust public debate. A public hearing on tax reform is essential, allowing Nigerians from all walks of life to engage meaningfully. This is how we build public trust and ensure inclusivity in policymaking.

“Matters of this magnitude require extensive deliberation and careful consideration—they should never be rushed. Public hearings must be conducted to allow for diverse opinions and inputs. When considering tax reforms and similar issues, it is insufficient to focus solely on the benefits to the government, particularly in terms of increasing revenue collection. We must also take into account the overall impact on the nation and the sustainability of all its regions.

“Furthermore, the government must sensitize the people and secure their buy-in for any policy changes. Trust and legitimacy are the foundation of effective governance, and without them, even the best-intended reforms may fail.

“Let us prioritize transparency, deliberation, and public engagement in charting the path forward. This is how we build a truly participatory democracy. A new Nigeria is possible!”

The National Secretary of the Labour Party, Umar Farouk, endorsed the opposition to the bills, stating they were not aimed at enhancing the nation’s fiscal policy framework.

“For me as a stakeholder, I am 100 per cent in support of the governors for the complete abolition or rejection of that new tax bill because it does not carry the popular opinion,” Farouk said.

“Aside from the people of the North, the downtrodden will also be affected. There is no point in a new derivation formula. If Nigeria is one, then let it be one.

“So, let there be equity in the distribution of our taxes and the national cake. The issue is that if they think Lagos is generating most of the VAT and other internally generated resources, then the north is providing the consumption of whatever is being generated. Everybody has his contribution. No region is idle.”

Northern lawmakers

Some Northern lawmakers in the House of Representatives on Monday said the opposition by legislators to the tax reform bills proposed by the President is irreversible until such a time the region is convinced that its economy would not be affected.

A lawmaker from the North-East, who spoke on condition of anonymity, noted that the speed with which the President wanted the bills to be given accelerated passage raised suspicions among the citizens.

When asked if northern lawmakers were being lobbied to support the bills, the lawmaker said there’s nothing wrong in being approached to support a public policy, adding however that “This one is a delicate matter that needs to be handled very carefully.”

“Our governors have spoken on this matter. The North is no longer what it used to be. Many years of insurgency have destroyed its economy. If you wake up with a policy aimed at reducing what ordinarily comes to them and with the N70,000 minimum wage; then there is going to be a problem.

“This is the issue at stake. We are not against the economic growth of this country as some reports are insinuating. Far from it! We are asking for time to consult more and when we are ready, we’ll say it.”

On his part, a federal lawmaker from Kano State and member of the New Nigeria People’s Party, Tijjani Ghali, backed the position of the Northern Governors Forum on the bills.

“I believe they have a fair understanding of the economy of Northern Nigeria where they came from. They represent the interests and the governance of their region and their state.

“Their position, I believe, is based on knowledge and understanding. They have taken the right step and I support their position to completely reject these bills because it’s not the right time to bring these kinds of bills.”

Southern lawmakers

Similarly, another lawmaker also from the North-East, described the opposition to the bills by the people of the region as total.

When asked if he has been approached to support the bills, he said, “What difference will it make? I am not aware and I’m yet to be contacted.”

Meanwhile, an All Progressives Congress lawmaker from Lagos State, Mr Babajimi Benson, said legislators from the North were likely to negotiate the bills at the appropriate time.

“Our brothers from the North are asking for time to study, review and probably negotiate on the four bills. They are key stakeholders and I am sure that in the fullness of time, we will all find a mutually beneficial meeting point,” Benson said.

On his part, the member representing Oriade/Obokun Federal Constituency, Osun State, Oluwole Oke, challenged those campaigning against the bills to pick out the areas of disagreement in the bills and bring same to a public hearing for more insights.

Oke told The PUNCH, “The opponents of these bills should put it in black and white which section of clauses in the proposed bills they disagree with and why? These can be discussed at a public hearing.”

The Chairman of the House of Representatives Committee on Media and Public Affairs, Akin Rotimi, said many caucuses were already discussing the bills in detail to have a resolution within the shortest possible time.

The lawmaker, who represents Ikole/Oye Federal Constituency, Ekiti State, said, “Stakeholders and caucuses across the parliament are consulting extensively to ensure we arrive at a consensus as soon as possible.”

Also expressing support for the bills, Lagos lawmaker representing Kosofe Federal Constituency, Kalifat Ogbara, said, “Consultations are ongoing.”

But the Chairman, Senate Committee on Ecology and Climate Change, Seriake Dickson, assured that the parliament would pass the tax reform bills despite opposition against them.

Dickson, who represents Bayelsa West Senatorial District, made this known on Monday.

Dickson said, “The Senate has passed the bills for second reading. Public hearings will take place and people should get ready to present their positions.

“The tax bill is a law like every other law and it has to go through the normal legislative process. Right now, taxes from Bayelsa State are paid to Lagos State and I don’t want that to continue.

“When there is the consumption of any goods or services from any state, it should be calculated and paid to that state. Now there is an opportunity to review the tax laws, to correct the anomalies and that’s why I’m in support.

“I know there are states that are feeling that when they apply the new sharing formula, they will earn less. It’s for them to raise those issues and bring the statistics. I don’t go by sentiments. I go by what is right and in the national interest.”

Asked whether there wouldn’t be uproar during the public hearing if wider consultations were not carried out, Dickson dismissed such an insinuation.

“There will be no uproar. A public hearing is an opportunity for people to present their matters, and nobody is going to be intimidated by the uproar.

“The PIA was passed. We wanted 10% which was what Yar’Adua proposed. They (federal lawmakers) reduced it to 3%. Heaven did not fall. These tax reform bills will pass and heavens will not fall,” he declared.

The lawmaker representing, Abia North, Senator Orji Kalu, commended the bill but faulted the Federal Government for not consulting enough with major stakeholders.

In an interview on Arise TV on Monday, the former Abia State governor noted that the Federal Government made a mistake by not involving the National Executive Council, Nigeria Governors Forum, and the Council of State in the tax reform proposals.

Presidency responds

Responding to the groundswell of opposition to the bills, the Presidency on Monday debunked claims that the tax bills would enrich Lagos or Rivers States at the expense of northern states.

It also insisted that changing the funding source of agencies such as the Tertiary Education Trust Fund and the National Agency for Science and Technology Infrastructure were not the same as scrapping them.

Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, made this known in a statement he signed Monday titled, ‘No part of tax reform bills recommends scrapping TETFUND, NASENI and NITDA…No provision will impoverish the North.’

Onanuga stated, “The tax reform bills will not make Lagos or Rivers more affluent and other parts of the country, as recklessly canvassed, poorer.

“The bills will not destroy the economy of any section of the country. Instead, they aim to enhance the quality of life for Nigerians, especially the disadvantaged, who are trying to make a living.”

Onanuga warned that while President Bola Tinubu “welcomes the public interest these bills have generated,” arguments must be based on facts so as not to mislead the public.

“Contrary to the lies being peddled, the bills do not suggest that NASENI, TETFUND, and NITDA will cease to exist in 2029 after the passage of the bills,” he added.

Some senators such as the former Senate Chief Whip, Ali Ndume, are calling for the withdrawal of the bills to allow for more extensive consultations.

Nonetheless, the Senate proceeded to pass the bills for a second reading, a move that has been met with harsh criticisms.

Governor Babagana Zulum of Borno State also warned that while the President could deploy his executive powers to pass the tax reform bills, there would be consequences for millions of Nigerians.

Zulum added that the proposed VAT-sharing model would only benefit Lagos and Rivers states.

In its statement, the Presidency said most reactions from political leaders and commentators “are not grounded in facts, reality, or sufficient knowledge of the bills.”

“While some commentators have attempted to incite the people against lawmakers, others have polarised one section of the country against another,” Onanuga said.

The Presidency said government agencies such as NASENI, TETFUND and NITDA are funded through budgetary provisions with company income tax and other taxes paid by the same businesses that are being overburdened with the special taxes.

“We cannot continue on this path or wait for 20 years if this country is to deliver the prosperity we need for our people.

“The proposal, as contained in section 59(3) of the Nigeria Tax Bill, only seeks to consolidate some of the earmarked taxes imposed on companies and replace them with a single tax to be shared with the key agencies as beneficiaries in a phased manner until 2030,” the statement added.

Onanuga said the time frame offers ample opportunity for the affected agencies to explore other funding sources in addition to budgetary allocations in line with the constitution and international best practices.

“Therefore, It is a misrepresentation of facts to conclude that changing an agency’s funding source amounts to scrapping it,” the Presidential Spokesman stated.

He added that none of the countries leading globally in education, science, engineering, or information technology have similar earmarked taxes.

“The government imposes major taxes, be it income tax, consumption tax, or other taxes, to channel resources to its areas of priority at the time.

“Imposing a separate tax to fund an agency is an aberration that has yet to yield results despite the huge burden on businesses. The tax bill seeks to address this problem,” he added.

The Presidency reasoned that relevant stakeholders and public analysts owe it a duty to properly educate themselves about the bills’ contents and avoid misleading the public for any reason.

It said, “We may be entitled to our opinions, but such views must be informed and based on facts, not emotions targeted at inflaming passions.

“In a period like this, when our people across the country look up to leaders for guidance and direction on matters of public importance, such as the Tax Reform Bills, leaders should be more measured in their public utterances to avoid heating the polity and polarising the country unduly.

It said while the President welcomed the public discourse on the bills, “He encourages leaders across the country, including governors, traditional rulers, civil society activists, students, trade associations, professional associations, and the general public to take advantage of the public hearings that the National Assembly will organise to present their views on how best to reform our taxes and fiscal regime.”

It added, “What is never in doubt is the imperative of changing the existing tax laws and administration that have become obsolete and unhelpful in achieving the growth and development we desire for our country.”

Meanwhile, the opposition to the bills has continued to gain ground as the Kano State House of Assembly on Monday rejected the tax reform bills.

The lawmakers rejected the bills following deliberations on the floor during the plenary presided over by the Speaker, Ismail Falgore.

The Majority Leader, Lawan Husseini, representing Dala state constituency, in a motion of ‘urgent public importance,’ emphasized the need for northern lawmakers as well as the Conference of Speakers not to allow the bills to see the light of day.

According to him, when passed into law, the bills will not be in favour of the people in the North, saying the decision of the Senate to pass the bills is condemnable.

“We view it as a calculated plan to sabotage the economy and even increase the hardship and impoverish the region in general,” he said.

Supporting the motion, Salisu Mohammed, representing Doguwa constituency, asked the Senate to focus on insecurity and unemployment, adding that the tax reform bills should not be subjected to a hasty legislative process.

Meanwhile, a former Presidential candidate of the New Nigeria People’s Party in the 2023 election, Senator Rabiu Kwankwaso, appealed to President Tinubu to reconsider his stance on the Tax Reform Bills in the interest of Nigerians.

Making the plea via his X handle on Sunday, Kwankwaso, said like former Presidents Olusegun Obasanjo and Goodluck Jonathan withdrew some critical bills in the interest of Nigerians, Tinubu should reconsider his stance.

As opposition to the bills gained ground, the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, explained that the objective of the tax reforms was to fix the economy for shared prosperity and not to generate more money as speculated.

Oyedele made the clarification when he was featured as one of the panelists on Channels Television’s Town Hall on Tax Reforms on Monday.

Oyedele said many misconceptions are being peddled about the bills “when it was obvious many of the critics have not taken out time to properly vet them.”

He said, “If I want to summarise it, I would say that the fiscal and tax system is like the knee on the neck of our economic prosperity as a people. It is important to state that the primary objective of the reforms is not to generate more revenue. I see people get that wrong every time. It is to fix the economy in a way that there can be shared prosperity.

“This is not rushing at all. I believe we consulted. We had one session with the Nigeria Governors Forum. They won’t say we didn’t consult them, they are saying we need to consult more, which we agree with because consultations will never end. Even after passing the bill, we must continue to consult.

“We had two sessions with the National Economic Council; we had almost a whole day with the finance commissioners from all over Nigeria. We’ve had at least four sessions with the head of the Internal Revenue Service from all 36 states plus the Federal Capital Territory.”

He added, “We’ve written to six geopolitical zones. We identified one governor per zone and wrote to them, to go and meet with them and their cabinet and discuss. Some of them did not have time for us. We appreciate the governor of Lagos State who said ‘Let’s even set up a committee between my cabinet and your team to work through the details.’”

On the benefits of the reform, he added, “For the subnational governments, the Federal Government will give five per cent of its share of VAT revenue to states. The FG has also agreed that the Electronic Money Transfer that is being shared among federal, state and local governments should (now) go to the states 100 per cent.”

While also speaking at the town hall meeting, a former Speaker of the House of Representatives, Yakubu Dogara, urged leaders in the country to shun regionalism and sectionalism while addressing the issues around the tax reform.

“I will address the question of leadership. We should remove the cap of regionalism, the cap of sectionalism, the cap of religion and put on the cap of leadership because that is what will resolve the current problems that we have,” Dogara said.

The former Speaker said he did not think the tax reform should stop just because some governors felt they were not properly consulted as he wondered if most state governors usually consulted many stakeholders before introducing some new laws.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Экзотика для романтического отпуска.

Екзотични почивки 2025 https://www.ekzotichni-pochivki.com/ .

MovieVault is a platform for movie enthusiasts who want organized, theme-based lists.

What’s inside:

A perfect ten for every topic: From biopics to films about AI.

Streaming links: Direct links to Prime Video.

Behind-the-scenes footage: Get a taste before watching.

Film stills: Perfect for social media shares.

No sign-up — just movies curated for you.

Explore unique genres at https://huzzaz.com/collection/cinepicker